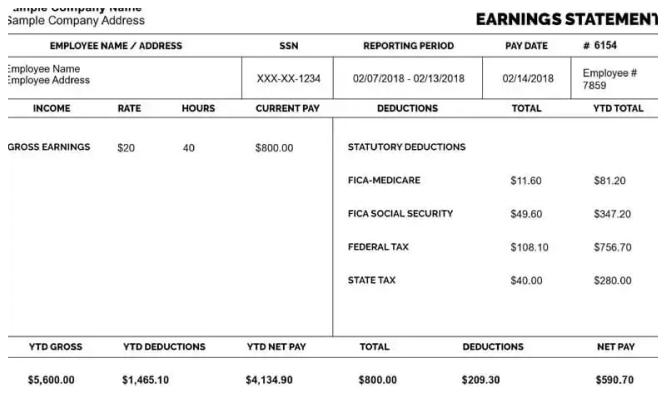

In today’s fast-paced world, managing finances efficiently is a priority for individuals, businesses, and freelancers alike. One of the tools that can make this process easier is an online paycheck creator. Whether you’re an employee looking to check your pay details or an employer trying to streamline payroll tasks, this tool can save you both […]

Author: jessicacarter

Check Stub Maker: A Solution for Managing Complex Payroll

Managing payroll in the education sector can be a daunting task. Schools, colleges, and universities often deal with a diverse workforce, including full-time faculty, part-time instructors, administrative staff, and temporary employees. With varying pay scales, benefits, and deductions, ensuring accuracy and transparency in payroll can be challenging. This is where a check stubs maker comes […]

Paystub Creators: A Game-Changer for Managing Seasonal Workers

Seasonal and temporary workers play a crucial role in many industries, from retail and hospitality to agriculture and event planning. Managing payroll for these workers, however, comes with unique challenges, such as fluctuating schedules, varying pay rates, and the need for detailed records. This is where a paystub creator can make all the difference. By […]

5 Reasons Why You Should Choose a Pay Stub Creator Free

Managing payroll can be a complex and time-consuming task, especially for small businesses, startups, or companies with limited resources. Whether you’re a small retail store, a growing tech company, or a service provider with hourly employees, ensuring that your staff is paid accurately and on time is essential. This is where a pay stub creator […]

The Pros and Cons of Online Check Stub Makers

In today’s fast-paced world, technology has made life easier in countless ways, including in the way we manage finances. One of the most helpful tools for freelancers, small business owners, and employees alike is the check stub maker. These online tools allow individuals to create professional, accurate check stubs without the need for specialized accounting […]