Managing payroll is an essential part of running a business, whether you’re managing a small team, running a startup, or working as an independent contractor. One of the most efficient tools to simplify payroll tasks is a check stub maker. This handy tool can save time, reduce errors, and provide a professional way to issue pay stubs to employees or yourself.

In this guide, we’ll break down everything you need to know about check stub makers, including what they are, how they work, and why they’re a must-have for payroll management.

What Is a Check Stub Maker?

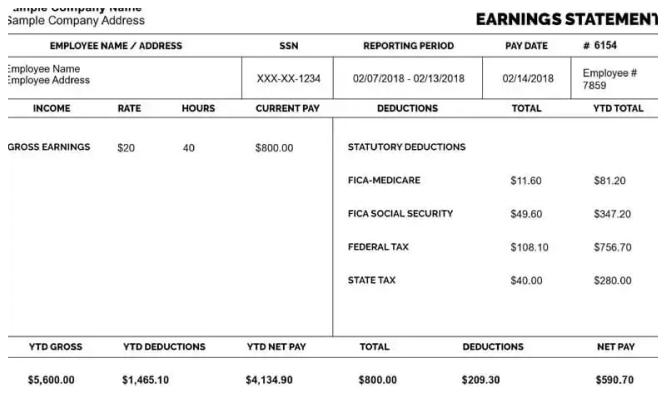

A check stub maker is an online or software-based tool that helps generate pay stubs. A pay stub, also called a paycheck stub, provides a detailed breakdown of an employee’s earnings, deductions, and net pay for a specific pay period.

These tools are designed to simplify the payroll process by automating calculations and creating professional, error-free stubs. Businesses of all sizes, as well as freelancers and contractors, use check stub makers to streamline their payroll operations.

How Does a Check Stub Maker Work?

Using a check stub maker is straightforward. Here’s how it typically works:

- Input Employee Information

- Enter details such as the employee’s name, address, and Social Security number.

- Add Payment Details

- Include information like hourly rate or salary, hours worked, and payment frequency (weekly, bi-weekly, monthly).

- Include Deductions

- Add deductions for taxes, health insurance, retirement contributions, and other applicable withholdings.

- Review and Generate

- Review the details for accuracy and generate a professional pay stub instantly.

- Download or Print

- Save the stub as a PDF for digital use or print it for physical records.

Who Can Benefit from a Check Stub Maker?

Check stub makers are versatile tools that cater to a wide range of users:

- Small Business Owners

- Managing payroll for a small team can be time-consuming. A check stub maker simplifies the process and ensures compliance with labor laws.

- Freelancers and Contractors

- Independent workers can use check stub makers to track their income, manage taxes, and provide proof of earnings for loans or rental applications.

- Startups

- New businesses often operate on tight budgets. Check stub makers are a cost-effective solution to manage payroll without expensive software.

- Remote and Gig Workers

- Employers managing remote or gig workers across different states can ensure accurate calculations for varied tax rates and deductions.

- HR Professionals

- HR teams can streamline payroll tasks, maintain accurate records, and provide transparent payment details to employees.

Why Use a Check Stub Maker?

Here are some compelling reasons to use a check stub maker:

- Time-Saving

- Automating payroll calculations and stub generation saves hours of manual work.

- Accuracy

- These tools minimize errors in calculations, ensuring accurate pay and deductions.

- Professionalism

- Generate professional-looking pay stubs that enhance the credibility of your business.

- Record-Keeping

- Maintain organized and secure payroll records for audits, tax filings, or employee inquiries.

- Compliance

- Adhere to federal and state labor laws by providing detailed pay information.

- Cost-Effective

- Many check stub makers offer free or affordable plans, making them accessible to businesses of all sizes.

Key Features to Look for in a Check Stub Maker

When choosing a check stub maker, consider the following features:

- User-Friendly Interface

- The tool should be easy to navigate, even for users with minimal technical expertise.

- Customizable Templates

- Look for tools that allow customization to include company branding and specific payment details.

- Automated Calculations

- Ensure the tool automatically calculates taxes, deductions, and net pay accurately.

- State and Federal Compliance

- Choose a tool that adheres to state and federal labor laws.

- Secure Data Storage

- Opt for tools that offer cloud-based storage with robust security features.

- Instant Generation

- A good check stub maker should generate pay stubs instantly.

- Mobile Compatibility

- Mobile-friendly tools enable you to create pay stubs on the go.

Top Check Stub Makers to Consider

Here are some popular check stub makers that can simplify your payroll process:

- 123PayStubs

- Known for its user-friendly interface and compliance features.

- PayStubCreator

- Offers customizable templates and supports various industries.

- Real Check Stubs

- Provides high-quality pay stubs with instant downloads.

- Stub Creator

- A cost-effective option for small businesses and freelancers.

- Check Stub Maker

- Ideal for businesses seeking a simple and efficient solution.

Common Mistakes to Avoid When Using a Check Stub Maker

- Entering Incorrect Information

- Double-check all details before generating a pay stub to avoid inaccuracies.

- Ignoring Tax Updates

- Ensure the tool you use is updated with the latest tax regulations.

- Not Customizing Templates

- Personalize stubs to include your business branding for a professional touch.

- Failing to Store Records

- Save digital copies of pay stubs to comply with record-keeping requirements.

- Choosing the Wrong Tool

- Research and select a tool that fits your specific payroll needs.

Tips for Maximizing the Benefits of a Check Stub Maker

- Train Your Team

- If multiple people handle payroll, ensure they know how to use the tool effectively.

- Stay Updated on Regulations

- Keep abreast of changes in labor laws and tax requirements to maintain compliance.

- Use Free Trials

- Many tools offer free trials. Test them before committing to a paid plan.

- Integrate with Payroll Software

- Some check stub makers integrate seamlessly with existing payroll systems for added convenience.

- Regularly Review Payroll Practices

- Periodically review your payroll process to identify areas for improvement.

Conclusion

A check stub maker is an indispensable tool for anyone managing payroll. It simplifies the process, ensures accuracy, and keeps you compliant with labor laws. Whether you’re a small business owner, a freelancer, or an HR professional, investing in a reliable check stub maker can save you time, money, and stress.

By choosing the right tool and using it effectively, you’ll not only streamline your payroll but also enhance professionalism and trust within your organization. Explore your options today and experience the benefits of a check stub maker firsthand.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

What is an eStub and How Does It Simplify Payroll Management?

How Does Verizon Paystub Help Ensure Payroll Accuracy and Transparency?

Understanding Your Pasadena Unified Paystub: A Quick Breakdown