Running a business comes with a wide range of responsibilities, and managing payroll is one of the most crucial. Timely and accurate paychecks are not only essential for maintaining employee satisfaction but also for staying compliant with legal and tax requirements. For small businesses and startups, handling payroll can seem overwhelming, especially when resources are limited. This is where a free paycheck creator can be a game-changer.

In this blog, we’ll explore how a free paycheck creator can maximize efficiency, its benefits for different types of businesses, and why it’s an indispensable tool for modern entrepreneurs.

What is a Free Paycheck Creator?

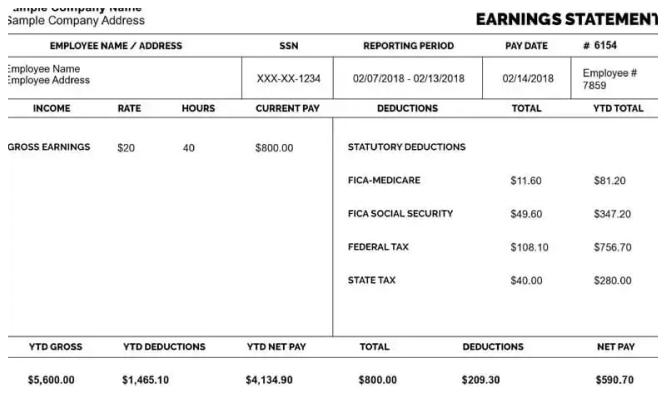

A free paycheck creator is an online tool designed to help businesses generate accurate paychecks for their employees without the need for complex software or expensive services. It simplifies the payroll process by allowing you to input basic details such as:

- Employee’s name and address

- Pay period

- Hours worked

- Hourly rate or salary

- Tax deductions

- Additional benefits or bonuses

Once the data is entered, the tool calculates the gross pay, deductions, and net pay automatically. Many paycheck creators also allow you to print pay stubs or save them as digital files for easy distribution.

Who Can Benefit from a Free Paycheck Creator?

1. Small Business Owners

Small business owners often juggle multiple roles. A free paycheck creator can save time and reduce the complexity of managing payroll. It eliminates the need for outsourcing payroll services, which can be costly for businesses with tight budgets.

2. Freelancers and Independent Contractors

For freelancers and independent contractors, creating professional pay stubs can help maintain accurate financial records. It’s also useful for situations where proof of income is required, such as applying for loans or renting an apartment.

3. Startups

Startups frequently operate with limited resources and manpower. A free paycheck creator provides an efficient and affordable solution to manage employee payments, ensuring smooth operations without stretching the budget.

4. Nonprofit Organizations

Nonprofits often rely on limited funding to achieve their missions. A free paycheck creator helps these organizations allocate more resources toward their goals by minimizing administrative costs.

Key Features of a Free Paycheck Creator

1. User-Friendly Interface

Most free paycheck creators are designed with simplicity in mind. The interface is straightforward, making it easy for anyone—even those with no prior payroll experience—to use.

2. Accurate Calculations

Payroll errors can lead to employee dissatisfaction and potential legal issues. A paycheck creator ensures precise calculations for gross pay, deductions, and net pay.

3. Customization Options

You can tailor pay stubs to include specific details such as overtime pay, bonuses, or reimbursements. This feature is particularly beneficial for businesses with diverse payment structures.

4. Compliance with Tax Laws

Many paycheck creators are updated with the latest tax regulations, ensuring that your payroll complies with federal and state laws.

5. Digital and Printable Pay Stubs

The ability to generate digital pay stubs or printable versions makes it easy to distribute payment details to employees, whether they’re in-office or remote.

How Does a Free Paycheck Creator Maximize Efficiency?

1. Saves Time

Manual payroll processing can be time-consuming, especially as your workforce grows. A paycheck creator streamlines the process, allowing you to focus on other important aspects of your business.

2. Reduces Errors

Human errors in payroll calculations can result in underpayments, overpayments, or compliance issues. A paycheck creator automates calculations, minimizing the risk of mistakes.

3. Cost-Effective

Instead of investing in expensive payroll software or outsourcing services, you can use a free paycheck creator to manage payroll efficiently. This is particularly advantageous for small businesses and startups.

4. Improves Record-Keeping

With digital pay stubs and saved records, it’s easier to track payments, manage audits, and prepare for tax season.

5. Enhances Employee Satisfaction

Providing employees with accurate and timely paychecks builds trust and satisfaction, which can lead to higher productivity and lower turnover rates.

How to Use a Free Paycheck Creator

Using a paycheck creator is simple. Here’s a step-by-step guide:

- Choose a Reliable Tool Look for a paycheck creator that offers the features you need, such as tax calculations, digital pay stubs, and customization options.

- Input Employee Details Enter basic information such as the employee’s name, address, and Social Security number.

- Enter Payment Information Specify the pay period, hours worked, and hourly rate or salary. Include any additional payments like bonuses or overtime.

- Add Deductions Include deductions for taxes, benefits, or retirement contributions. The tool will calculate the totals automatically.

- Generate and Save Paychecks Once all details are entered, the tool will generate the paycheck. You can save or print it as needed.

Best Practices for Using a Paycheck Creator

1. Keep Employee Records Updated

Ensure that all employee information is accurate and up-to-date to avoid errors in payroll processing.

2. Review Paychecks Before Distribution

Double-check the generated paychecks for accuracy before distributing them to employees.

3. Stay Informed About Tax Regulations

While most tools are updated with current tax laws, it’s always a good idea to stay informed about any changes that may affect your payroll.

4. Secure Employee Data

Choose a tool that offers robust data security features to protect sensitive employee information.

Why a Free Paycheck Creator is Essential for Modern Businesses

In today’s fast-paced business environment, efficiency is key. A free paycheck creator not only simplifies payroll management but also offers flexibility and scalability as your business grows. Whether you’re a small business owner, freelancer, or part of a nonprofit organization, this tool provides an accessible and reliable solution for managing employee payments.

By adopting a free paycheck creator, you can:

- Save time and reduce administrative burdens

- Ensure compliance with tax regulations

- Enhance employee satisfaction

- Maintain accurate financial records

- Allocate more resources to growing your business

Final Thoughts

Managing payroll doesn’t have to be a daunting task. With a free paycheck creator, you can streamline the process, reduce errors, and focus on what matters most—growing your business. This tool is not just a convenience; it’s a necessity for businesses looking to maximize efficiency and stay competitive in today’s market.

So why wait? Explore the benefits of a free paycheck creator today and take the first step towards a more efficient and productive business operation.