In today’s fast-paced world, technology has made life easier in countless ways, including in the way we manage finances. One of the most helpful tools for freelancers, small business owners, and employees alike is the check stub maker. These online tools allow individuals to create professional, accurate check stubs without the need for specialized accounting knowledge or expensive software. However, like any tool, online check stub makers come with both advantages and disadvantages. In this blog, we’ll explore the pros and cons of online check stub makers, so you can make an informed decision about whether or not they’re right for you.

What is a Check Stub Maker?

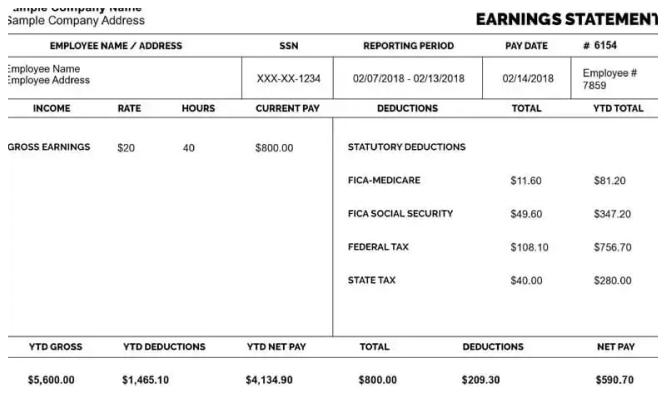

Before diving into the pros and cons, let’s define what a check stub maker is. A check stub maker is an online tool that allows individuals or businesses to create detailed and professional pay stubs. These pay stubs break down an employee’s earnings, taxes, deductions, and other financial details for a specific pay period. With just a few inputs, the check stub maker generates a pay stub, which can then be downloaded, printed, or stored digitally.

For freelancers, contractors, and small business owners who handle their own payroll, a check stub maker is a valuable tool. It ensures that the pay stub is accurate and professional-looking, saving time and reducing errors. But like all tools, it’s important to understand the pros and cons before committing.

Pros of Using an Online Check Stub Maker

- Cost-Effective

One of the biggest advantages of using an online check stub maker is the cost savings. Traditionally, businesses or freelancers had to hire accountants or purchase expensive payroll software to create pay stubs. This process could be costly, especially for small businesses or individuals working on a tight budget.

With an online check stub maker, you can create pay stubs for a fraction of the cost. Many online tools offer free versions or affordable subscription models, making them accessible to a wide range of users. This is especially helpful for freelancers and small business owners who need to keep their expenses low.

- Ease of Use

Online check stub makers are designed with user-friendliness in mind. Most platforms have simple, easy-to-navigate interfaces that allow you to generate pay stubs in just a few minutes. All you need to do is enter basic information such as the employee’s name, pay period, wages, and deductions, and the tool will automatically calculate everything for you.

This simplicity makes it ideal for people without accounting experience. You don’t have to worry about complex calculations or formatting issues—just enter your details, and the check stub maker does the rest. This ease of use also makes it easier for small business owners to manage payroll without needing to hire an accountant or payroll service.

- Time-Saving

Creating check stubs manually can be a time-consuming process, especially if you have multiple employees or clients. With a check stub maker, you can create accurate and detailed pay stubs in a matter of minutes. The tool automatically calculates taxes, deductions, and other necessary information, so you don’t have to spend hours figuring out the numbers.

This time-saving aspect is especially helpful for freelancers and small business owners who are juggling multiple tasks. Instead of dedicating hours to payroll, you can use those hours to focus on growing your business or providing your services to clients.

- Accuracy

A check stub maker reduces the likelihood of human error. By automating the process of calculating taxes, deductions, and other financial information, the tool ensures that your pay stubs are accurate and comply with tax laws. This is particularly important for freelancers and small business owners who are responsible for filing their taxes correctly.

The accuracy provided by a check stub maker can also help avoid disputes with employees or clients over pay. With detailed, accurate pay stubs, everyone is on the same page when it comes to earnings, taxes, and deductions.

- Customization

Many online check stub makers offer customization options, allowing you to tailor the pay stubs to your needs. You can add your business logo, customize the layout, and include any additional fields necessary for your particular situation. For example, if you’re a freelancer, you might want to add a section for your hourly rate, commissions, or tips.

This customization allows you to create pay stubs that reflect the unique structure of your freelance or small business work. It also helps maintain a professional appearance, which can be crucial when sharing pay stubs with clients or financial institutions.

- Access to Records

Another benefit of using a check stub maker is the ability to access your pay stubs anytime, anywhere. Most online tools allow you to store your pay stubs digitally, either on the tool’s platform or in cloud storage. This means you can easily access your pay stubs whenever you need them, whether for tax filing, applying for loans, or simply keeping track of your earnings.

This digital access also eliminates the risk of losing important physical pay stubs, ensuring that your financial records are always safe and organized.

Cons of Using an Online Check Stub Maker

- Limited Features in Free Versions

While many online check stub makers offer free versions, these versions often come with limitations. You may be restricted to a certain number of pay stubs per month or be limited in terms of customization options. Some free tools might also include watermarks or advertisements on the generated pay stubs, which could detract from the professionalism of the document.

If you require more advanced features, such as bulk pay stub creation or additional customization options, you may need to upgrade to a paid version. This can add to your costs, although it is typically still more affordable than hiring an accountant or using a traditional payroll service.

- Potential for Data Privacy Risks

Whenever you enter personal or financial information online, there is always a risk of data breaches or privacy concerns. While reputable check stub makers take steps to protect your information, there’s still a chance that your sensitive financial data could be exposed if the platform is not secure.

To minimize this risk, make sure to choose a check stub maker that is trustworthy and has strong data security protocols in place. Look for tools that offer encryption and secure storage options to ensure your information remains protected.

- Not Ideal for Complex Payroll Needs

For freelancers or small businesses with simple payroll needs, a check stub maker is an excellent solution. However, if your business has more complex payroll requirements—such as multiple income sources, varying pay rates, or complicated tax situations—a pay stub maker might not be sufficient. In these cases, you may need to rely on more specialized payroll software or an accountant to ensure that all the necessary calculations are accurate.

- Dependence on Internet Access

Since most check stub makers are online tools, you’ll need a reliable internet connection to access and use them. This can be an issue for individuals in areas with poor internet connectivity or those who prefer to work offline. Additionally, if the service experiences downtime or technical difficulties, you may not be able to generate pay stubs when you need them.

- Limited Support for Multiple Employees

Some online check stub makers are designed for individuals or small businesses with only one or a few employees. If you have a larger team or need to generate multiple pay stubs regularly, you may find the process time-consuming. While some tools do offer bulk pay stub creation, they may not be as efficient as dedicated payroll software for businesses with large numbers of employees.

Conclusion

Using an online check stub maker can provide many benefits, including cost savings, time efficiency, accuracy, and customization. It’s an excellent tool for freelancers, small business owners, and anyone who needs to create professional pay stubs quickly and easily. However, like any tool, there are also some drawbacks, including limitations in free versions, potential privacy risks, and issues with complex payroll needs.

Ultimately, the decision to use a check stub maker depends on your specific situation. If you have simple payroll needs and are looking for an affordable and efficient way to manage your pay stubs, an online check stub maker could be a perfect fit. However, if you have more complex payroll requirements or need additional features, you may need to explore other options. By weighing the pros and cons, you can make the best choice for your freelance or small business needs.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

What is an eStub and How Does It Simplify Payroll Management?

How Does Verizon Paystub Help Ensure Payroll Accuracy and Transparency?

Understanding Your Pasadena Unified Paystub: A Quick Breakdown